39 coupon rate formula calculator

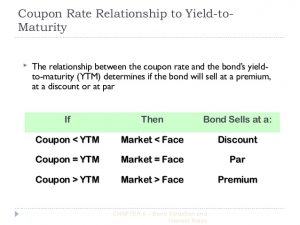

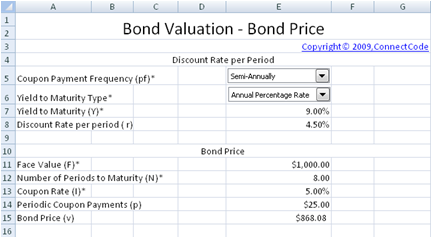

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon rate formula calculator

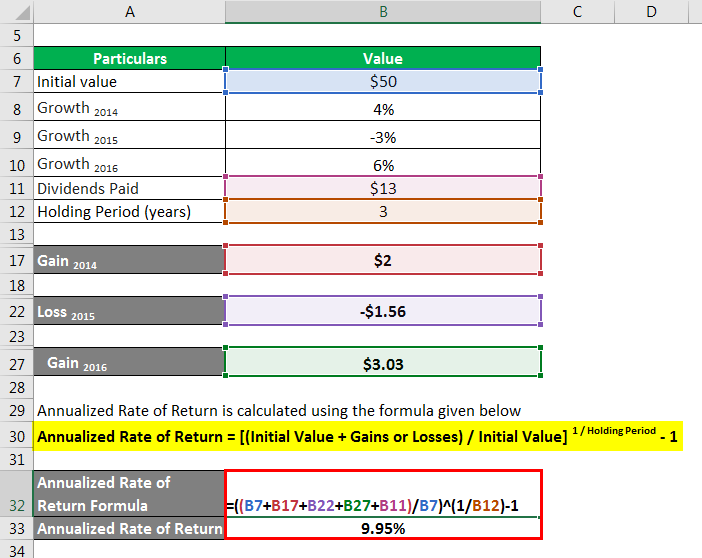

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. How to Calculate ROI from Coupons & Discounts? - Voucherify Let's start off with an easy one; You want to push out a public, fixed-code code to promote your brand. Something that can be shared on Groupon or ad banners, e.g. "voucherify-black-friday". You can create it in minutes with the Voucherify manager. Just to remind you, Voucherify supports five types of discounts: Amount (e.g. $10 off), Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

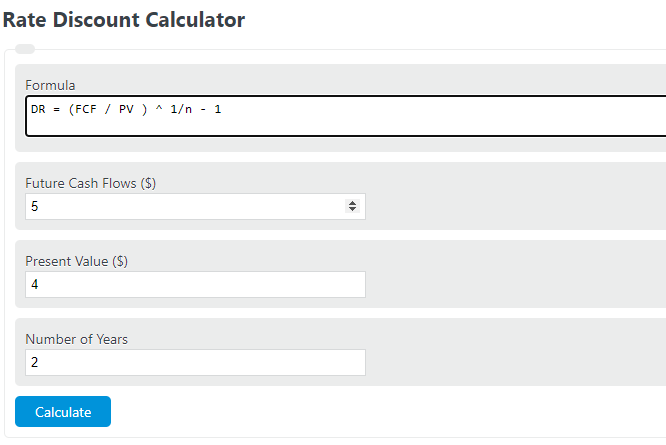

Coupon rate formula calculator. › required-rate-of-return-formulaRequired Rate of Return Formula | Calculator (Excel template) Step 4: Finally, the required rate of return is calculated by applying these values in the below formula. Required Rate of Return = (Expected Dividend Payment / Current Stock Price) + Dividend Growth Rate. Relevance and Uses of Required Rate of Return Formula. The required rate of return formula is a key term in equity and corporate finance. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate: Definition, Formula & Calculation - Study.com C = i / p where: C = coupon rate i = annualized interest (or coupon) p = par value of bond Coupon Rate Calculation Example Let's look at an example. XYZ Company, the fictitious maker of widgets, is... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

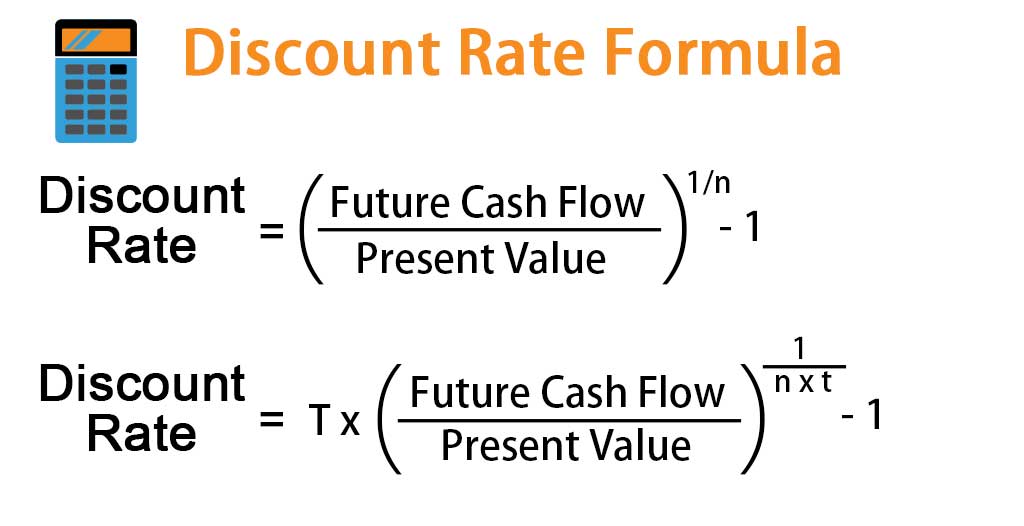

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, › knowledge › irr-mom-returnInternal Rate of Return (IRR): Formula and Excel Calculator If we were to calculate the IRR using a calculator, the formula would take the future value ($210m) and divide by the present value (-$85m) and raise it to the inverse number of periods (1 ÷ 5 Years), and then subtract out one – which again gets us 19.8% for the Year 5 internal rate of return (IRR). What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

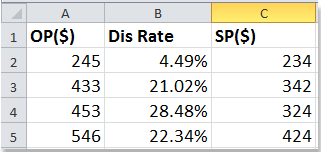

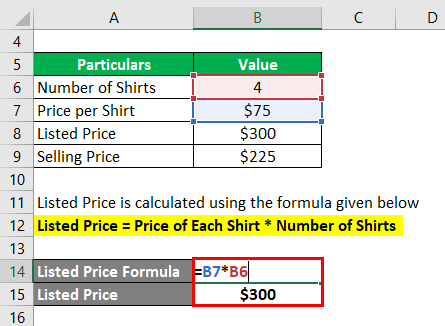

› capitalization-rate-formulaCapitalization Rate Formula | Calculator (Excel template) Relevance and Uses of Capitalization Rate Formula The capitalization rate is useful for investors to compare properties. If all things are equal and any two properties have capitalization rates of 10% and 5%, then the investor should choose the 10% return offered by the property. Coupon Percentage Rate Calculator Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is calculated by dividing annual coupon payment by face value of bond.The formula is expressed as follows Coupon Rate formula = ( (Coupon Payment*Frequency of Payment) / Face Value) × 100 › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. Discount Calculator 10% of $45 = 0.10 × 45 = $4.50. $45 - $4.50 = $40.50. or. 90% of $45 = 0.90 × 45 = $40.50. In this example, you are saving 10%, or $4.50. A fixed amount off of a price refers to subtracting whatever the fixed amount is from the original price. For example, given that a service normally costs $95, and you have a discount coupon for $20 off ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ...

Coupon Rate Template - Free Excel Template Download Coupon Rate Template. This coupon rate template will calculate a bond's coupon rate based on the total annual coupon payments and the face value of the bond. As is customary with CFI templates the blue values are hardcoded numbers and black numbers are calculations dependent on other cells. Here is a snippet of the template:

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values.

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Coupon Payment | Definition, Formula, Calculator & Example Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2].

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

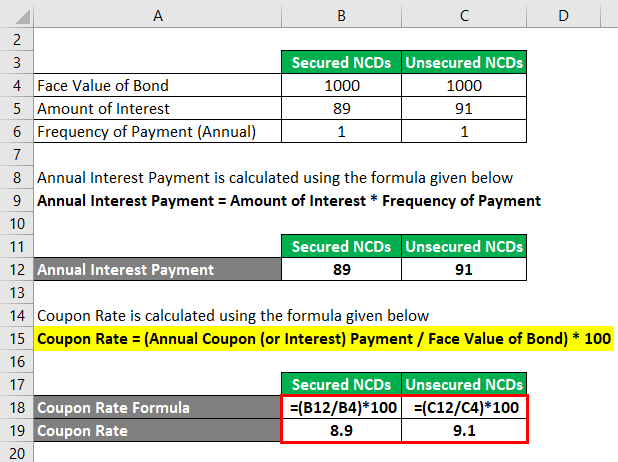

How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100 3 Ideal Examples to Calculate Coupon Rate in Excel

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Bond Yield: Formula and Calculator [Excel Template] Bond Coupon Rate Formula. The coupon rate can be calculated by dividing the annual coupon payment by the bond's par value. Coupon Rate = Coupon / Bond Par Value; For example, given a $1,000 par value and bondholder entitled to receive $50 per year, the coupon rate is 5%. Coupon Rate = $50 / $1,000; Coupon Rate = 5%

Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

Post a Comment for "39 coupon rate formula calculator"