40 current yield coupon rate

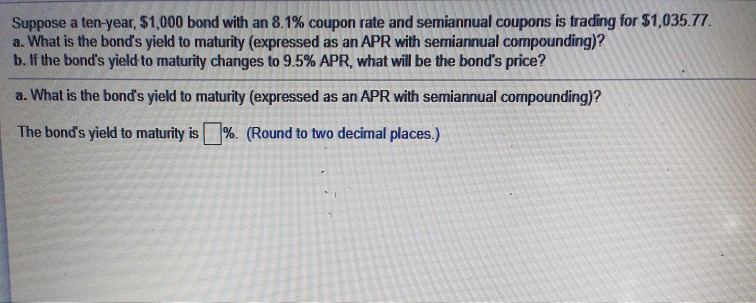

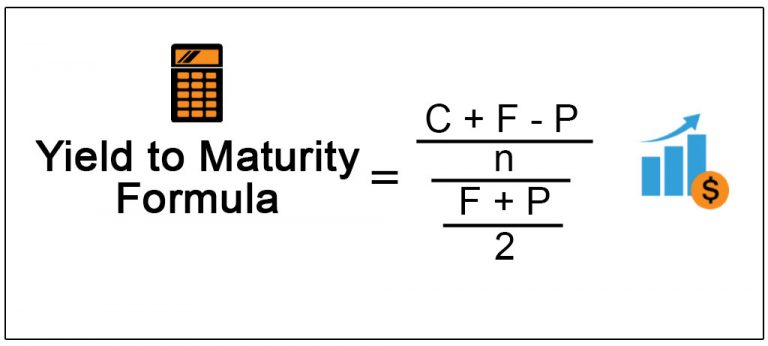

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face ... Yield to Maturity | Formula, Examples, Conclusion, Calculator Mar 24, 2021 · The bond has a price of $920 and the face value is $1000. The annual coupons are at a 10% coupon rate ($100) and there are 10 years left until the bond matures. What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below the par value. In such a situation, the yield-to-maturity is higher than the coupon rate.

Current yield coupon rate

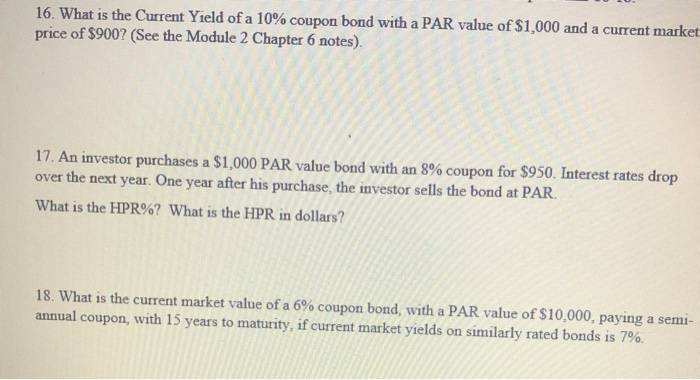

Current Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53% Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest. Current Yield - Investopedia How Current Yield Is Calculated If an investor buys a 6% coupon rate bond for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is ($60) /... Yield to maturity - Wikipedia If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity ... and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change. So the bond is priced approximately …

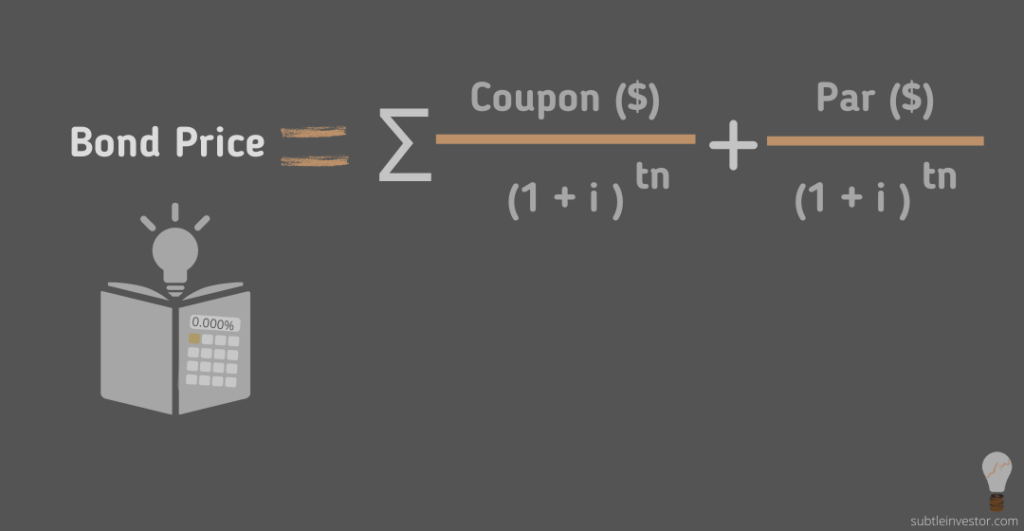

Current yield coupon rate. Bond Yield to Maturity (YTM) Calculator - DQYDJ Current Yield (%): Simple yield based upon current trading price and face value of the bond. ... Annual Coupon Rate: 10%; Coupon Frequency: 2x a Year; 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25%. What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did … Yield to Maturity | Formula, Examples, Conclusion, Calculator 24/03/2021 · C = future cash flows/coupon payments; r = discount rate (the yield to maturity) F = Face value of the bond; n = number of coupon payments ; Let’s use the figures from above to work out the value of the bond, assuming the coupon payments are made once per year: Here we can see that the current fair valuation of the bond is $7.15 more than the purchase price, … Yield to maturity - Wikipedia An ABCXYZ Company bond that matures in one year, has a 5% yearly interest rate (coupon), and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

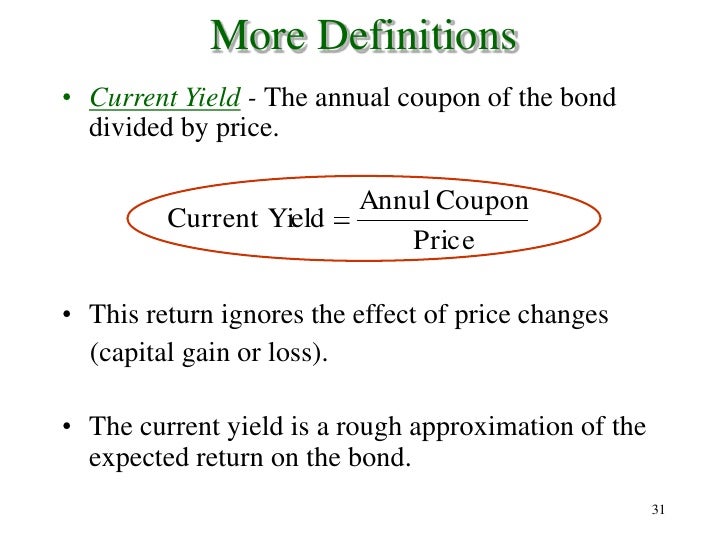

The current yield on a bond is the stated coupon rate See Page 1. The current yield on a bond is the stated (coupon) rate divided by the bond price as a percentage of face value or, alternatively, the sum of the coupon payments for one year divided by the bond price. 13. A bond with a stated coupon rate of 5% that is selling at 98.54% of face value has a current yield of 5 / 98.54 = 5.074%. Current Yield Calculator | Calculate Current Yield of a Bond Current Yield = Coupon Payment / Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That's it! Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond Yield Calculator - Compute the Current Yield - DQYDJ The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang Interest rate fluctuates in the coupon rate. The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity. The market price keeps on changing so it's better to purchase a bond at a discount which represents a larger share of the purchase price. 5; Current Yield | Formula, Example, Analysis, Calculator The current yield focuses more on its actual value now than on its value in the future. Current Yield Example Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate? Current yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. = = $ % $ = $ $ = % Shortcomings of current yield. The current yield refers only to the yield of the bond at the current moment.

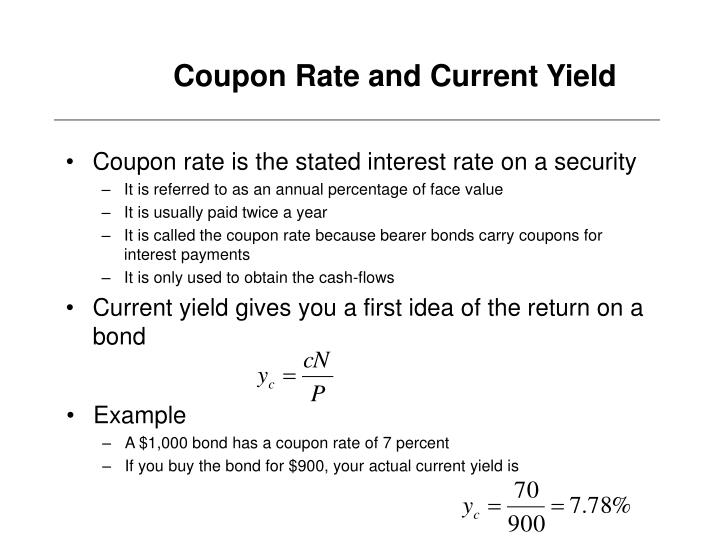

Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

What Are Coupon and Current Bond Yield All About? - dummies What current yield means to your investment. Current yield is derived by taking the bond's coupon yield and dividing it by the bond's price. Suppose you had a $1,000 face value bond with a coupon rate of 5 percent, which would equate to $50 a year in your pocket. If the bond sells today for 98 (meaning that it is selling at a discount for ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ...

The current yield on a bond is the stated coupon rate 13. A bond with a stated coupon rate of 5% that is selling at 98.54% of face value has a current yield of 5 / 98.54 = 5.074%. 14. A bond that is trading at $1,058 and makes annual coupon payments that sum to $50 has a The yield to maturity (YTM) of a bond, on an annual basis, is the effective annual yield and is used for bonds that pay an ...

Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Bond Yield Calculator Current bond yield = Annual interest payment / Bond's current clean price Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it should be multiplied with 0.01 to convert it from percent.

Individual - TIPS: Rates & Terms - TreasuryDirect Follow the link and locate the Index Ratio that corresponds to the interest payment date for your security. Multiply your original principal amount by the Index Ratio. This is your inflation-adjusted principal. Multiply your inflation-adjusted principal by half the stated coupon rate on your security (i.e., 2%).

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Current Yield vs. Yield to Maturity: What's the Difference? The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 Calculating the yield to maturity is more complicated.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Later, the bond's face value drops down to $900; then its current yield rises to 7.8% ($70 / $900). Usually, the coupon rate does not change, it is a function of the annual payments, and the face value and both are constant. Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond

Current Yield: Bond Formula and Calculator [Excel Template] The Current Yield measures the expected annual return of a bond and is calculated by dividing the annual coupon by the current market price.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator 27/06/2021 · Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) Calculator. Algebra Civil Computing Converter Demography Education Finance Food Geometry Health Medical Science Sports Statistics. Formulas; Contact; Search. Coupon Rate Calculator. Home › Finance › Economic Benefits. Posted by Dinesh on …

Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · Conversely, when a bond sells for less than par, which is known as a discount bond, its current yield and YTM are higher than the coupon rate. Only on occasions when a bond sells for its exact par ...

Current Yield of a Bond - Meaning, Formula, How to Calculate? The reason why current yield fluctuates and deviates from the annual coupon rate is because of the changes in interest rate market dynamics Market Dynamics Market Dynamics is defined as the forces of market constituents responsible for the shift in the demand and supply curve and are therefore accountable for creating and reducing the demand ...

Post a Comment for "40 current yield coupon rate"