42 zero coupon convertible bond

An Introduction To Bond Investments | Ally - Do It Right Convertible bonds are a type of security that combines a debt investment (bonds) with an equity component (stocks). As an investor in convertible bonds, you receive coupon payments and expect face value at maturity, just like the average bondholder. ... (Exceptions to this rule include zero-coupon bonds, which are sold at a deep discount to ... Board of GAIL (India) approves borrowings up to Rs 25000 cr - issue of rupee denominated, listed / unlisted / secured / unsecured i non-convertible /redeemable / cumulative / non-cumulative / taxable / tax free, debentures / bonds (including but not limited to green bonds / zero coupon / market linked debentures / fixed or floating coupon rates / index linked / interest rate swap / options with / without …

Australia Government Bonds - Yields Curve The Australia 10Y Government Bond has a 3.341% yield.. 10 Years vs 2 Years bond spread is 38.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.85% (last modification in August 2022).. The Australia credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 27.24 and implied probability of default is 0.45%.

Zero coupon convertible bond

What Are Convertible Bonds? - The Motley Fool A convertible bond's conversion ratio is the number of stock shares an investor will receive should they choose to convert their bond. A bond with a face value of $1,000 and a conversion price of... › terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... Domestic bonds: Goldman Sachs International, 0% 7jan2032, EUR (3684D ... Domestic bonds: Goldman Sachs International, 0% 7jan2032, EUR (3684D, Structured) FR0014006OH7 Download Copy to clipboard Add to WL Structured product, Foreign bonds, Zero-coupon bonds Status Outstanding Amount 30,000,000 EUR Placement *** Redemption (put/call option) *** (-) ACI on No data Country of risk United Kingdom Current coupon - Price -

Zero coupon convertible bond. Quant Bonds - Asset Swap Spread - BetterSolutions.com Uses the Zero Coupon Yield curve. By combining the two you can change the coupon payments to either fixed or floating. This is the yield of the bond minus the swap rate for the corresponding maturity swap. A fixed-rate bond will be combined with an interest rate swap in which the bond holder pays a fixed coupon and receives a floating coupon. Three reasons why convertibles thrive when rates rise When I traded my first convertible bond in the early 1980s the coupon was 5.5% - in fact, it was that rising rate environment that stimulated the then nascent convertible bonds market. 'Big Short' Burry sells all but a single stock on dead cat bounce fears. Now as interest rates have spiked again, the days of zero-coupon paper has ended ... South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.170% yield.. 10 Years vs 2 Years bond spread is 333 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.50% (last modification in July 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%. Zero Coupon 2025 Fund | American Century Investments Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity. Although you can potentially earn a dependable return if you hold your shares to maturity, you should be prepared for dramatic price fluctuations which may result in significant gains or losses if sold prior to maturity. C

Ascent Solar Completes Delivery of Another Major Contract and Announces ... Net loss for the first six-months ended June 30, 2022 was $6.6M, which included a substantial non-cash interest expense of approximately $2.1M, booked as a result of the conversion of $9.2M of... Is Beyond Meat Now an 'Impossible' Investment? - RealMoney Beyond's zero coupon convertible bonds due in 2027 are trading at 39¢ on the dollar for a yield to maturity of over 21%. Investors who believe in Beyond Meat's financial survival over the next five... Your Complete Guide to Corporate Bonds - The Motley Fool A corporate bond is a loan to a company for a predetermined period, with a predetermined interest yield it will pay. In return, the company agrees to pay interest (typically twice per year) and ... 8 different types of bonds you can invest in India They aim to lessen the inflation impact on coupon payments and face value. Based on the inflation rate, the principal amount is adjusted, and the interest payments are done considering the adjusted principal. Image Source: iStock Zero-coupon bonds These bonds are issued at a discount. It is paid back to the bondholder at the par value.

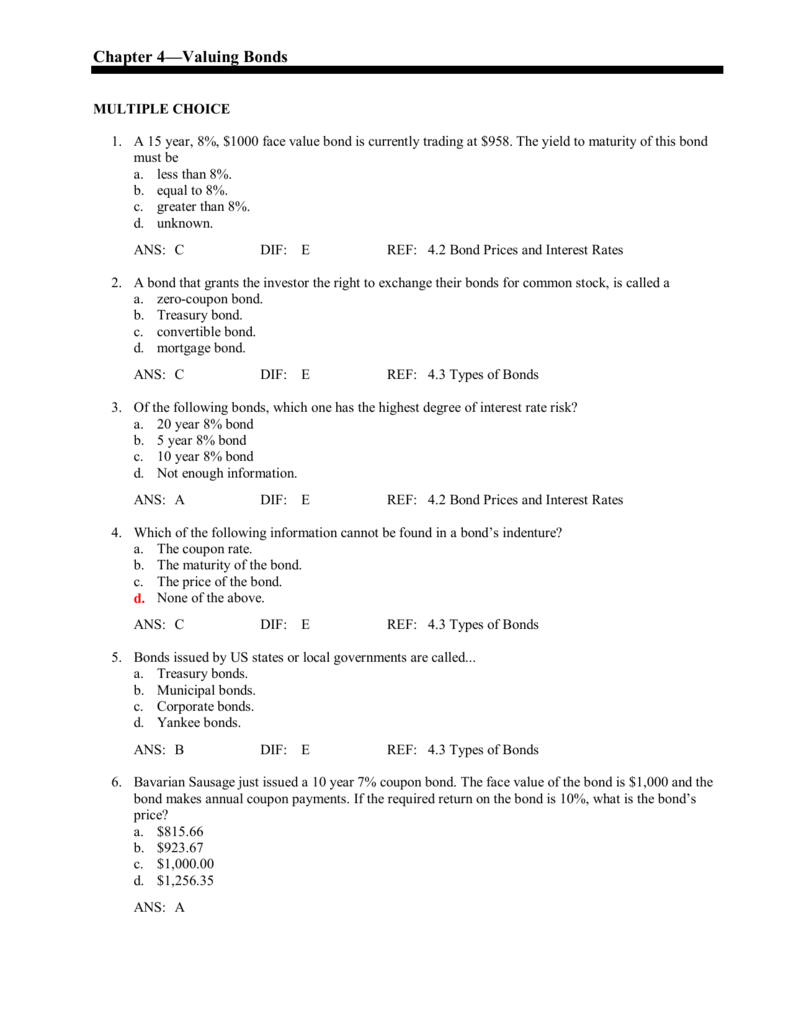

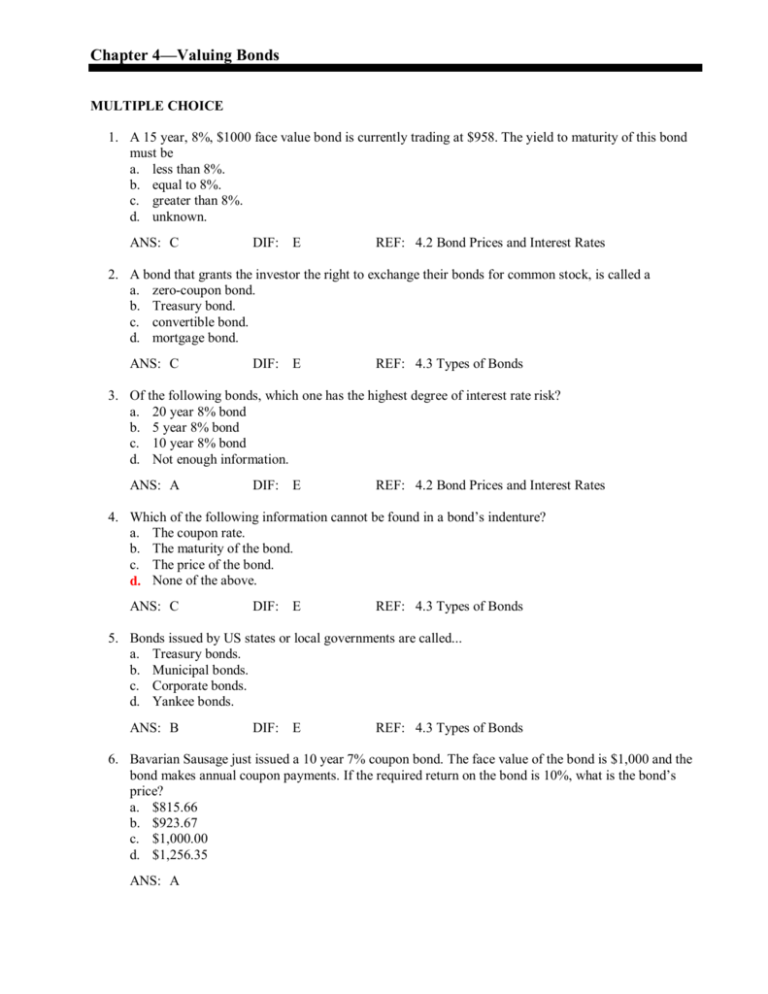

› ~zz1802 › Finance 303Chapter 6 -- Interest Rates - California State University ... Discount bond: a bond that sells below its par value Premium bond: a bond that sell above its par value (2) Yield to maturity (YTM): the return from a bond if it is held to maturity Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. What should be YTM for the bond? SEI Institutional Investments Trust High Yield Bond Fund Class A No ... The fund primarily invests in high yield, below investment grade debt securities including corporate bonds and debentures, convertible and preferred securities, zero coupon obligations and... Domestic bonds: USA, Bills 0% 28jul2022, USD (182D) US912796S595 Domestic bonds: USA, Bills 0% 28jul2022, USD (182D) US912796S595 Download Copy to clipboard Zero-coupon bonds, Bills Issue Issuer JCRA - *** Scope - *** Status Matured Amount 115,229,006,700 USD Placement *** Redemption (put/call option) *** (-) ACI on No data Country of risk USA Current coupon - Price *** % Yield / Duration - Busted Bond Definition - Investopedia The term "busted bond" can also refer to convertible debt securities that have an insignificant conversion value because conversion price is much higher than the market value of the underlying...

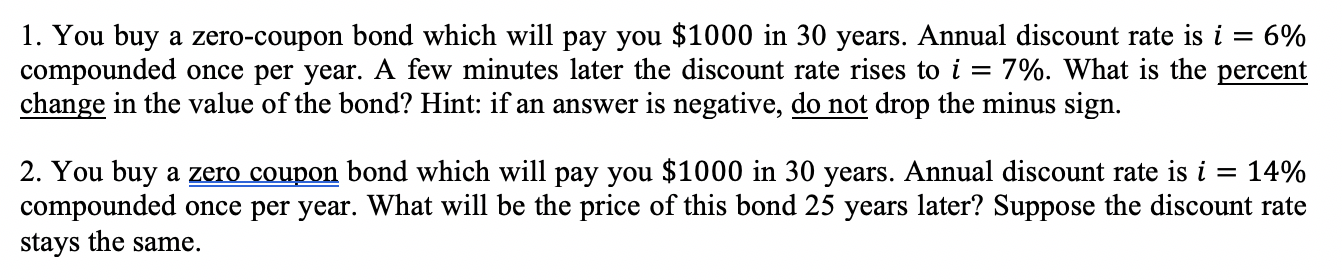

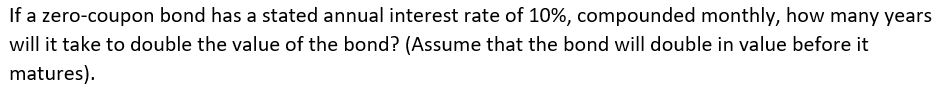

Fixed Income Investments Analysis August 2022 Past Paper Determine the yield for a 15 year zero coupon bond with maturity value of Sh.1,000 selling at the price of Sh.252.12. (2 marks) 4. A corporate bond with a coupon rate of 10% maturing 1 March 2027 is purchased with a settlement date of 17 July 2021. The next coupon payment will be made on 1 September 2021. The yield to maturity is 6.5%.

UPDATE - SolarEdge to sell zero-coupon bonds in USD-550m offering This corresponds to a conversion price of USD 277.80 per share of common stock. The securities will be convertible into cash, shares of common stock or a combination of both. They will not be redeemable prior to their maturity date and will be senior unsecured obligations of SolarEdge. (USD 1.0 = EUR 0.858)

Bonds: What They Are & How They Work | Seeking Alpha Zero-coupon bonds: do not pay interest but trade at a deep discount instead, resulting in a profit at maturity; Convertible bonds: can be converted to stock; Callable and puttable bonds: ...

2022 | News Releases | Mitsubishi Chemical Group Corporation Announcement Regarding Adjustment of Conversion Price for Zero Coupon Convertible Bonds due 2024 May 19, 2022 Personnel. Notice Regarding Executive Personnel Changes May 13, 2022 Financial Results. Consolidated Financial Results for the Fiscal Year Ended March 31, 2022 (Under IFRS) ...

Ad-Hoc | ams OSRAM ams launches EUR 600 million 7-year zero-coupon convertible bond placement. Read more. 2018/02/20. ams proposes revised shares-only earn-out structure to former Heptagon shareholders ... Proposal replaces cash/share combination with revised shares-only distribution contingent on approval threshold.

Difference Between Loan and Bond - Ask Any Difference These are zero-coupon bonds, convertible bonds, callable bonds, and puttable bonds. The inverse to interest rates of a bond depends on the risk of return. A bond with a high risk of return yields more inverse to interest rates. As an example, a government bond where the chances of payment are higher valued less.

› us › productsiShares Convertible Bond ETF | ICVT - BlackRock Key Facts. Net Assets of Fund as of Aug 17, 2022 $1,914,849,296. Fund Inception Jun 02, 2015. Exchange Cboe BZX formerly known as BATS. Asset Class Fixed Income. Benchmark Index Bloomberg U.S. Convertible Cash Pay Bond > $250MM Index. Bloomberg Index Ticker BCT5TRUU. Shares Outstanding as of Aug 17, 2022 25,450,000. Distribution Frequency Monthly.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Zero-Coupon Certificate of Deposit (CD) Definition - Investopedia A zero-coupon CD is a type of CD that does not pay interest throughout its term. Instead, the investor is compensated by receiving a face value upon maturity that is higher than the instrument's...

Neo Solar to pocket USD 120m from bond sale - Renewablesnow.com The three-year notes will be issued on October 27, according to the statement. Priced at TWD 18 (USD .57/EUR 0.52) per share, the bonds will come with a 10.4% conversion premium, based on the closing share price of TWD 16.3 per share on October 18. (USD 1.0 = EUR 0.910) (TWD 10 = USD .317/EUR 0.289)

2022 - Nippon Steel Announcement Regarding Adjustment of Conversion Price for Zero Coupon Convertible Bonds Due 2024 and Zero Coupon Convertible Bonds Due 2026 (198KB) Jun. 23, 2022. Notice of Executive Management of Nippon Steel Corporation on June 23, 2022 (151KB) Jun. 08, 2022.

› gstripsInvest in G-SEC STRIPS India - Bondsindia.com The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

corporatefinanceinstitute.com › bondsBonds - Overview, Examples of Government and Corporate Bonds Feb 04, 2022 · 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local governments or states are called municipal bonds. They come with a greater risk than federal government bonds but offer a higher yield. Examples of Government Bonds. 1.

China Railway Construction : ADJUSTMENT TO CONVERSION PRICE OF THE US ... The Company announces that the conversion price of the US$ Bonds will be adjusted from HK$9.65 per H Share to HK$9.44 per H Share, with effect from 25 July 2020 as a result of the payment of the Final Dividend. - 1 -. Reference is made to (i) the announcement of China Railway Construction Corporation Limited (the " Company ") dated 19 January ...

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia fluctuations in the market price of a bond prior to maturity. Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield

Types of Bonds - Example | Characteristics and Value of Bonds Zero Bonds and Low Coupon Bonds Junk Bonds and High Yield Bonds Convertible Bonds Mortgage Bonds Mortgage bonds are general kinds of bonds that are secured by some real asset. Subordinated Debt and General Credit These bonds are of a little lower in rank and claim as compared to mortgage bonds. Debentures

› articles › bondsConvertible Bonds: Pros and Cons for Companies and Investors Jun 06, 2022 · Another is that the company can offer the bond at a lower coupon rate ... A zero-coupon convertible is a fixed income instrument that combines a zero-coupon bond and a convertible bond. more.

Domestic bonds: Goldman Sachs International, 0% 7jan2032, EUR (3684D ... Domestic bonds: Goldman Sachs International, 0% 7jan2032, EUR (3684D, Structured) FR0014006OH7 Download Copy to clipboard Add to WL Structured product, Foreign bonds, Zero-coupon bonds Status Outstanding Amount 30,000,000 EUR Placement *** Redemption (put/call option) *** (-) ACI on No data Country of risk United Kingdom Current coupon - Price -

Post a Comment for "42 zero coupon convertible bond"