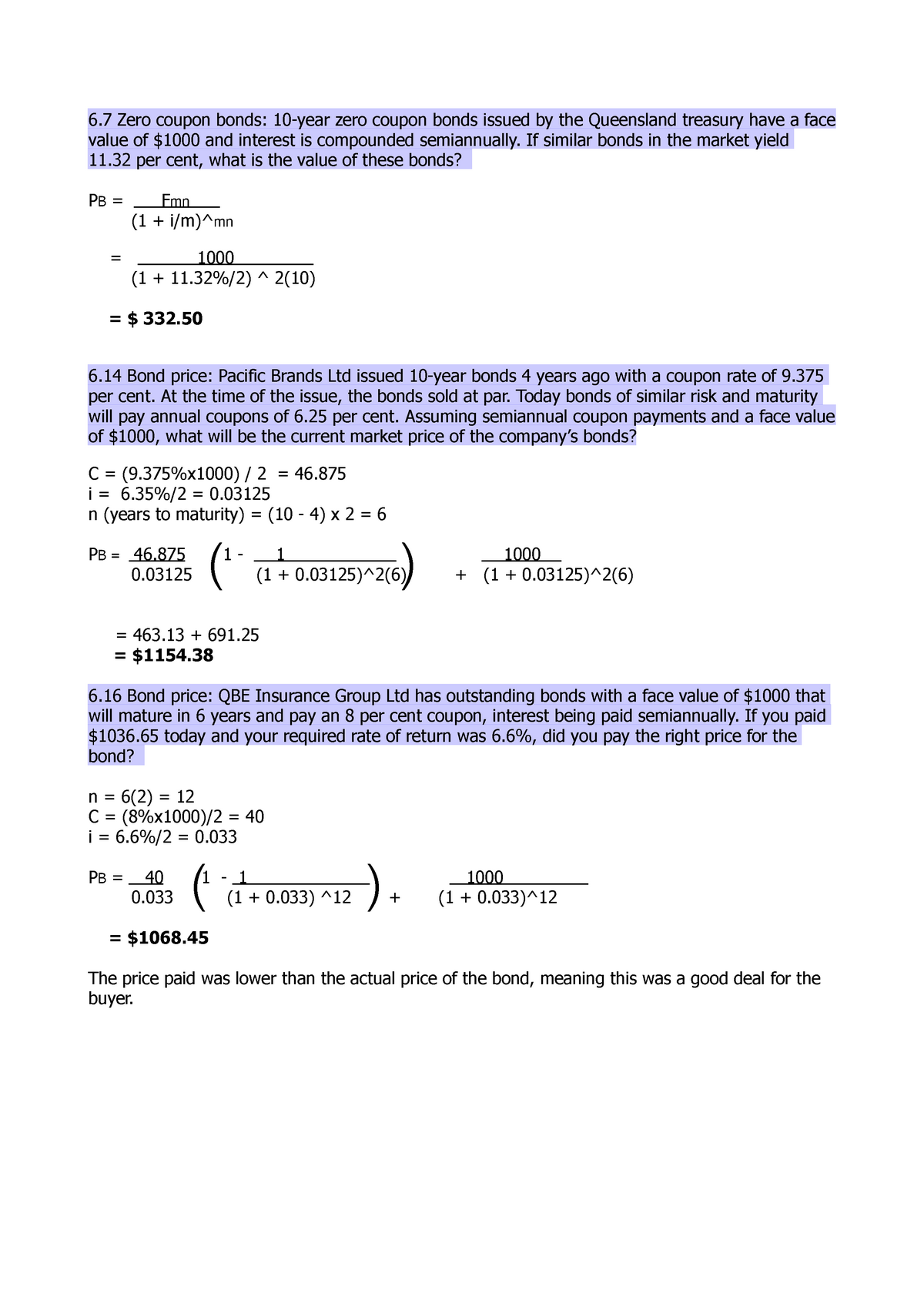

42 a 10 year bond with a 9 annual coupon

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If Ask an Expert Tax Questions Finance Questions A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * 1/1 a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d.

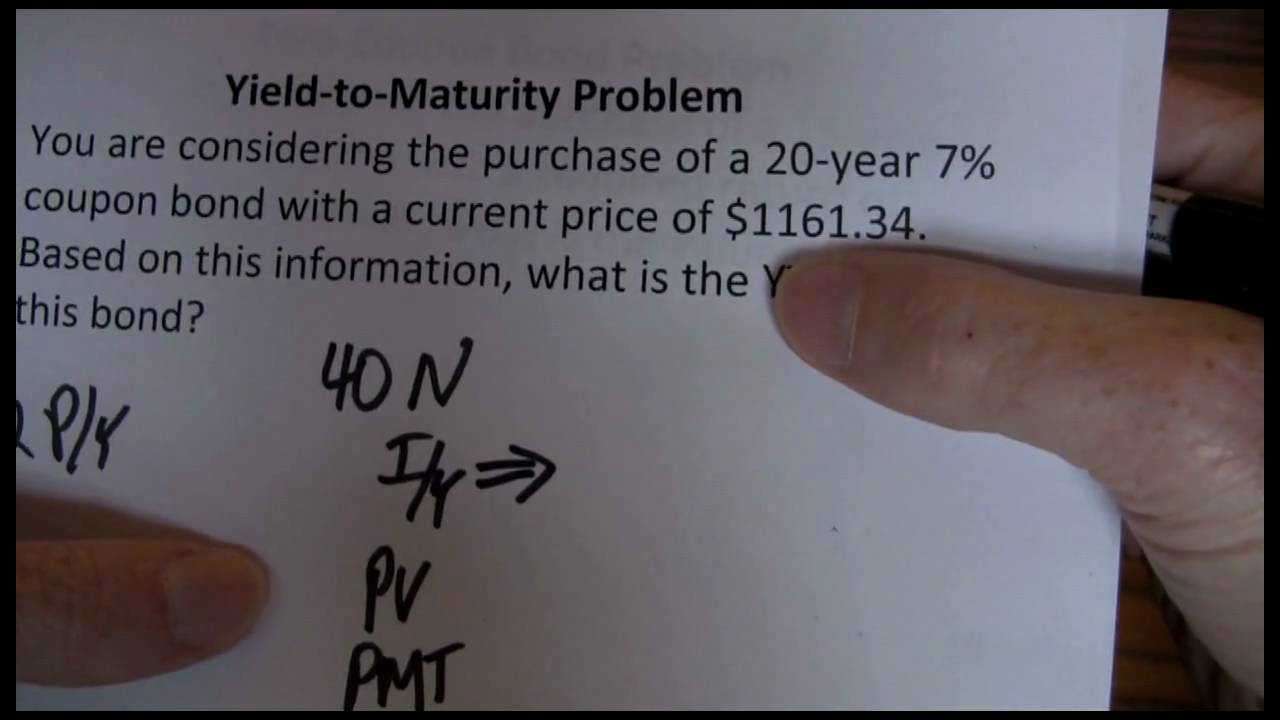

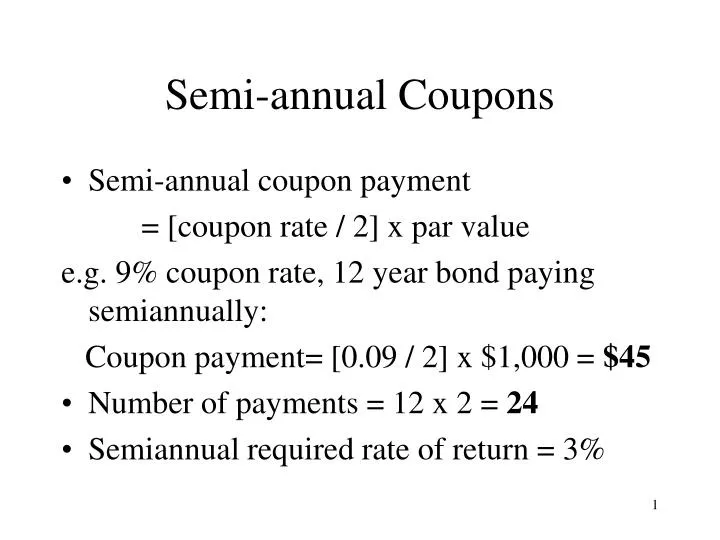

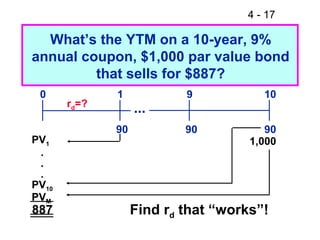

63 a 12 year bond has a 9 percent annual coupon a A bond with 10 years to maturity has a face value of $1,000. The bond pays an 8 percent semiannual coupon, and the bond has a 9 percent nominal yield to maturity. What is the price of the bond today? a. $908.71 b. $934.96 c. $935.82 d. $952.37 e. $960.44 Bond value--semiannual payment Answer: Diff: E b. $ 934.96 68.

A 10 year bond with a 9 annual coupon

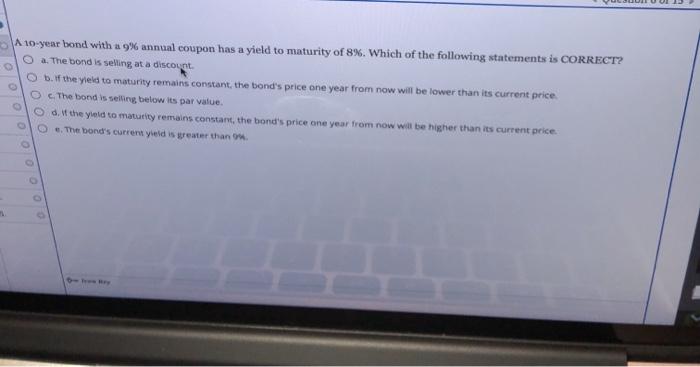

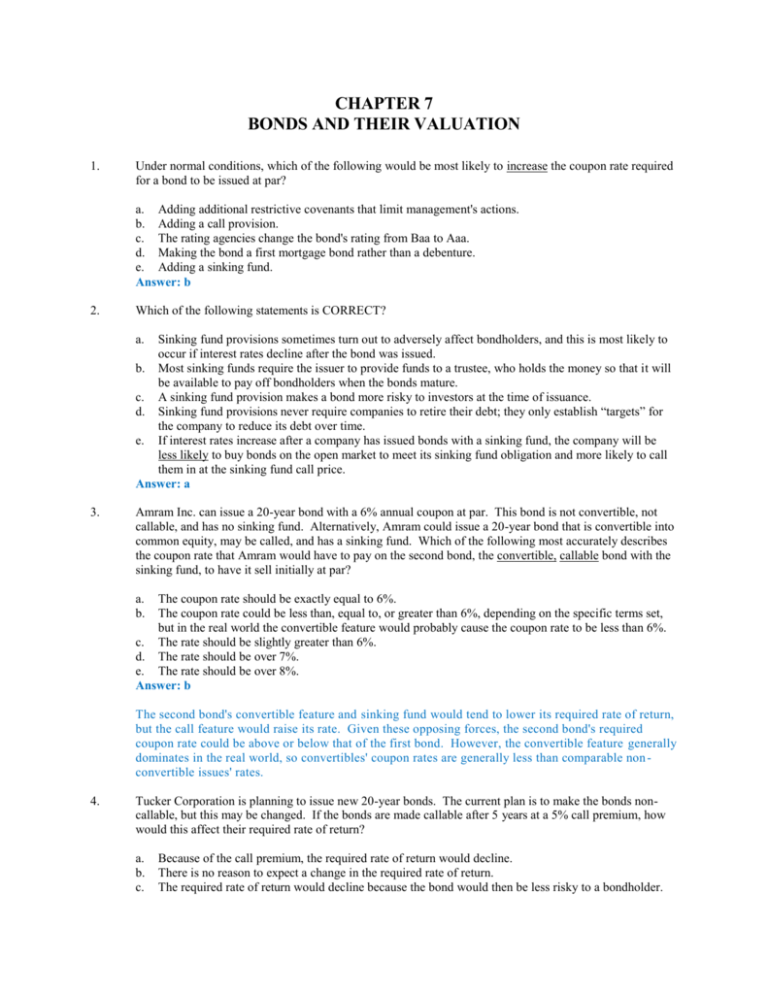

Solved What is the yield to maturity on a 10-year, 9 percent - Chegg According to the given information, Years to maturity = 10 Annual coupon rate = 9% Annual coupon payment = Face value of the bond * Annual coupon rate = $1000 * 9% = $90 Face value of the bond = $1000 Present value of the bond = $887 CAlculating the … View the full answer Previous question Next question A semiannual coupon bond with a coupon rate of 9% and face… - JustAnswer A semiannual coupon bond with a coupon rate of 9% and face value of $1000 trades at $900. It matures in 15 years. What - Answered by a verified Business Tutor ... Consider the following bonds: Bond Coupon Rate (annual payments) ... Garfunkel Corporation's bonds will mature in 10 year. The bonds have a face value of $1000 and an 8% coupon rate ... a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual coupon has a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

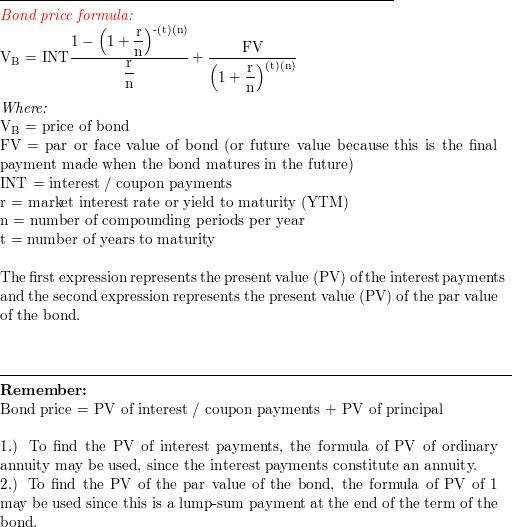

A 10 year bond with a 9 annual coupon. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg See the answer A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value Expert Answer A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid... Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue Yield to maturity calculator P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity . Let's take an example to understand how to use the formula. Let us find the yield - to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9.

A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Bond Price Calculator | Formula | Chart Annual coupon rate: 5% Coupon Frequency: Annual Years to maturity: 10 years Yield to maturity (YTM): 8% The bond valuation calculator follows the steps below: Determine the face value. The face value is the balloon payment a bond investor will receive when the bond matures. For our example it is face = $1,000. Calculate the coupon per period. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Solved 1) A 10-year bond with a 9% annual coupon has a yield - Chegg Question: 1) A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a premium to par value. b. The bond is selling at a discount. c. The bond is selling below its par value. d. The bond will earn a rate of return greater than 8%. This problem has been solved! chapter5practicetest.docx - A 10-year bond with a 9% annual... chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select chapter5practicetest.docx - A 10-year bond with a 9% annual... School Texas State University Course Title FIN 3313 Uploaded By tynupe Pages 6 Ratings 71% (7) Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates... How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

A 10 year corporate bond has an annual coupon payment A 10-year corporate bond has an annual coupon payment of 9 percent. The bond is currently selling at par ($1,000). Which of the followingstatements is most correct? a. The bond's yield to maturity is 9 percent. b. The bond's current yield is 9 percent. c. If the bond's yield to maturity remains constant, the bond's price will remain at par. d.

A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value. b. the bond is selling at a discount. c. the bond will earn a rate of return greater than 8%. d. the bond is selling at a premium to par value

Answered: A 9% semiannual coupon bond matures in… | bartleby Q: A bond has a $1,000 par value, 7 years to maturity, and a 9% annual coupon and sells for $1,095.… A: A bond is a financial security that is sold by large entities to borrow funds. Generally, it is…

Answered: 7) Consider a 10-year 10% annual coupon… | bartleby 7) Consider a 10-year 10% annual coupon bond with par value of $1,000 and a yield to maturity of 9%. The modified duration of this bond is 8.75 and the convexity measure is 64.80. If the yield to maturity increases to 10.50%, the predicted percentage change in the price of the bond (due to both duration and convexity) will be: a) +10% b) -13.12 ...

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond s yield to maturity?

Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

What is the yield to maturity for a 3 year bond with a 10% annual ... The yield of maturity will be 10% itself , Option C is the right answer. The missing option are What is the yield to maturity for a 3 year bond with a 10% annual coupon if the bond is trading at par? A) 11.00% B) 9.00% C) 10.00% D) 9.75% What is the meaning of Trading at Par ? At par means the bond or stock is trading at its face value ,

Finance Test 1 Part Two Flashcards | Quizlet A 10-year, $1,000 face value, 10% coupon bond with annual interest payments. d. All 10-year bonds have the same price risk since they have the same maturity. e. A 10-year, $1,000 face value, 10% coupon bond with semiannual ... 17. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT ...

a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual coupon has a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A semiannual coupon bond with a coupon rate of 9% and face… - JustAnswer A semiannual coupon bond with a coupon rate of 9% and face value of $1000 trades at $900. It matures in 15 years. What - Answered by a verified Business Tutor ... Consider the following bonds: Bond Coupon Rate (annual payments) ... Garfunkel Corporation's bonds will mature in 10 year. The bonds have a face value of $1000 and an 8% coupon rate ...

Solved What is the yield to maturity on a 10-year, 9 percent - Chegg According to the given information, Years to maturity = 10 Annual coupon rate = 9% Annual coupon payment = Face value of the bond * Annual coupon rate = $1000 * 9% = $90 Face value of the bond = $1000 Present value of the bond = $887 CAlculating the … View the full answer Previous question Next question

![Solved] A 20-year, $1,000 par value bond has a 9% semi-annual ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/20153973.jpg)

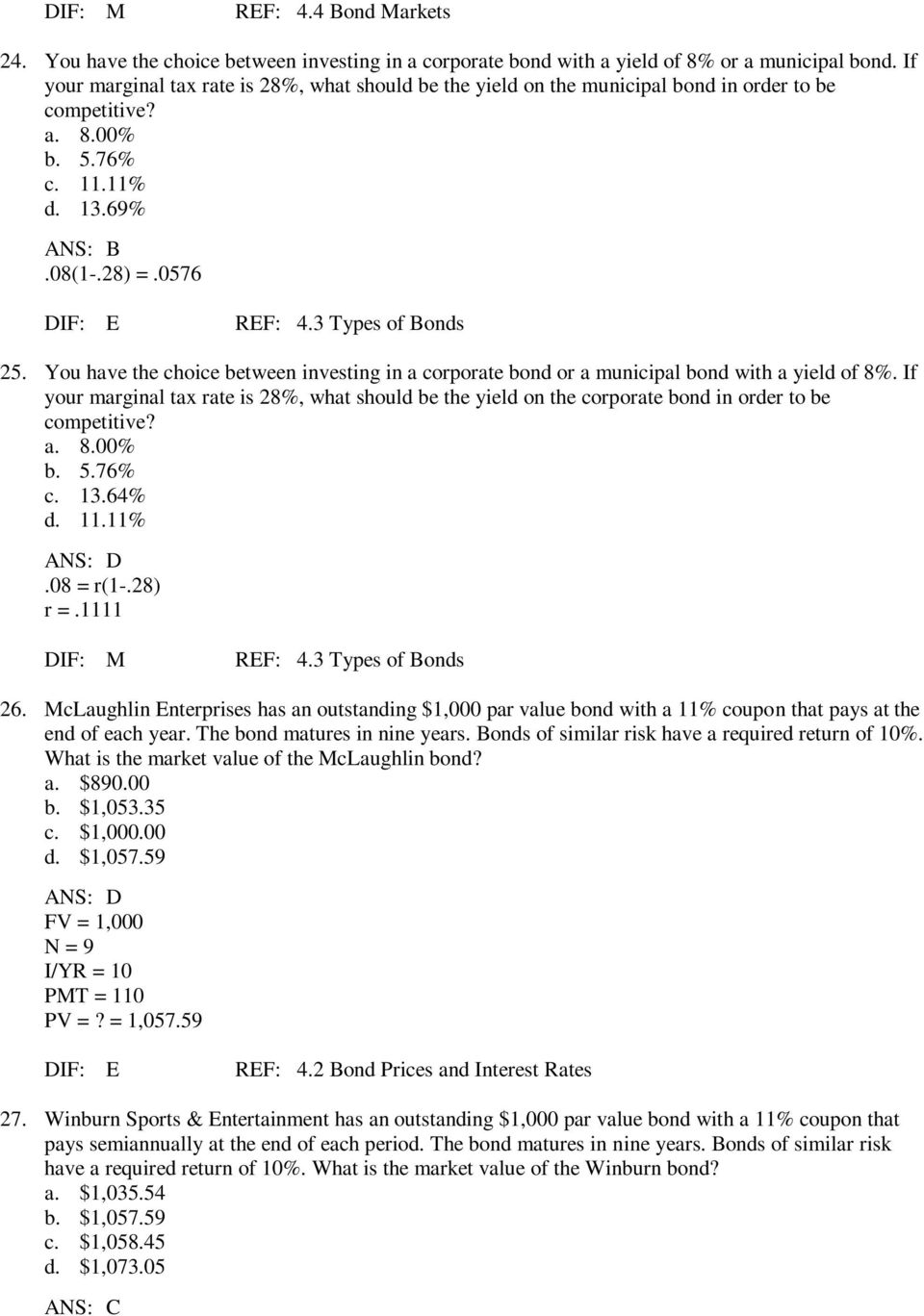

Post a Comment for "42 a 10 year bond with a 9 annual coupon"