41 present value of zero coupon bond calculator

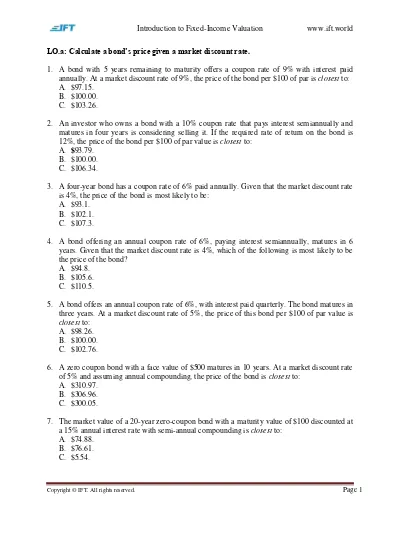

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Present value of zero coupon bond calculator

Macaulay Duration - Overview, How To Calculate, Factors The greater the coupon payments, the lower the duration is, with larger cash amounts paid in the early periods. A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds. 45 present value of zero coupon bond calculator › terms › pPresent Value (PV) Definition - investopedia.com Feb 01, 2022 · Learning how to use a financial calculator to make present valu... Bond Valuation: Calculation, Definition, Formula, and Example Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

Present value of zero coupon bond calculator. Calculate the present value of a $1,000 zero-coupon bond with ... Calculate the present value of a $1,000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. "Get 15% discount on your first 3 orders with us" Use the following coupon "FIRST15" Order Now Zero Coupon Bond Present Value Calculator Sanders are set to meet Tuesday night. Details: 1 months ago Offer Details: 1 months ago Offer Details: months. Check out the zero coupon bond present value calculator table below to see how SpotHero's SFO parking rates compare to that of alternative options all prices displayed are subject to change. Aye but got base game free on epic. Zero Coupon Bond Calculator - Calculator App The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a ... How to Calculate PV of a Different Bond Type With Excel - Investopedia The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. For example: Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% ...

Calculate the present value of a $1,000 zero-coupon bond with ... Calculate the present value of a $1,000 zero-coupon bond with August 12, 2022 / in / by admin Calculate the present value of a $1,000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. present value of zero coupon bond calculator - afscott.com present value of zero coupon bond calculator Have Any Questions? (844) 782-4340. limerick junction to limerick colbert. zendikar rising expeditions scryfall; is temporary insanity real. best places to visit in israel; pass inclusion for students with behavior disorders; braeburn school uniforms. 42 present value of zero coupon bond calculator Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM A zero-coupon bond is a debt security that does not pay interest but instead trades at ... Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

How to Calculate Bond Price in Excel (4 Simple Ways) It refers to the accumulation of present values of all likely Coupon payments plus the present value of the par value at maturity. 4 Easy Way to Calculate Bond Price in Excel There are different types of bond prices such as Zero-Coupon Bond Price , Annual Coupon Bond Price , Semi-Annual Coupon Bond Price , Dirty Bond Price , etc. Follow the ... Zero Coupon Bond Price Calculator Excel (5 Suitable Examples) - ExcelDemy Formula Breakdown. PV(C6,C7,0,C5) → The PV function calculates the present value of a loan or investment based on a constant interest rate.; C6 is the rate, which is referred to as Yield to Maturity (YTM); C7 is the nper, which is the total number of payment periods; 0 is the pmt, that is the payment made on each period.For zero coupon bond, as there is no periodic payment, pmt is 0 How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond Formula. The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1) −1. How do you calculate a zero-coupon rate from the bond yield? The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2.

Bond Valuation: Calculation, Definition, Formula, and Example Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

45 present value of zero coupon bond calculator › terms › pPresent Value (PV) Definition - investopedia.com Feb 01, 2022 · Learning how to use a financial calculator to make present valu...

Macaulay Duration - Overview, How To Calculate, Factors The greater the coupon payments, the lower the duration is, with larger cash amounts paid in the early periods. A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds.

Post a Comment for "41 present value of zero coupon bond calculator"