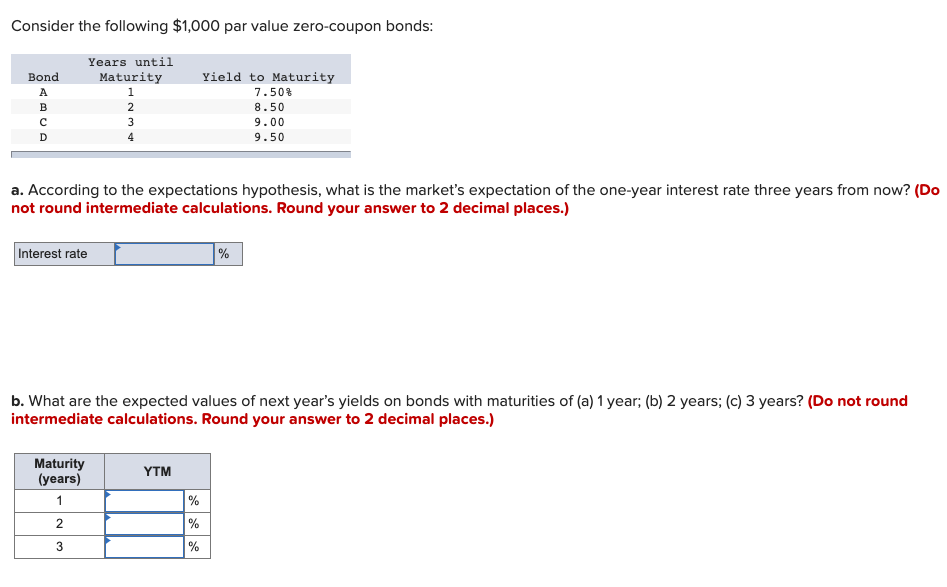

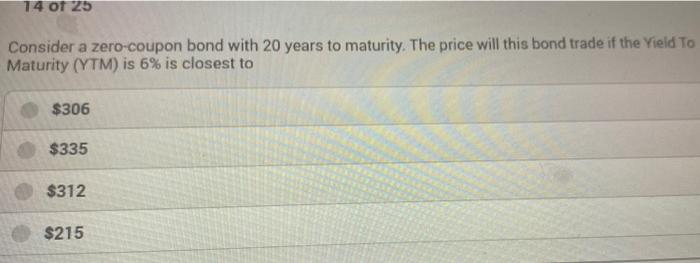

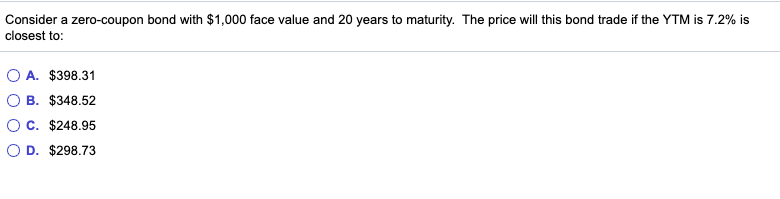

40 consider a zero coupon bond with 20 years to maturity

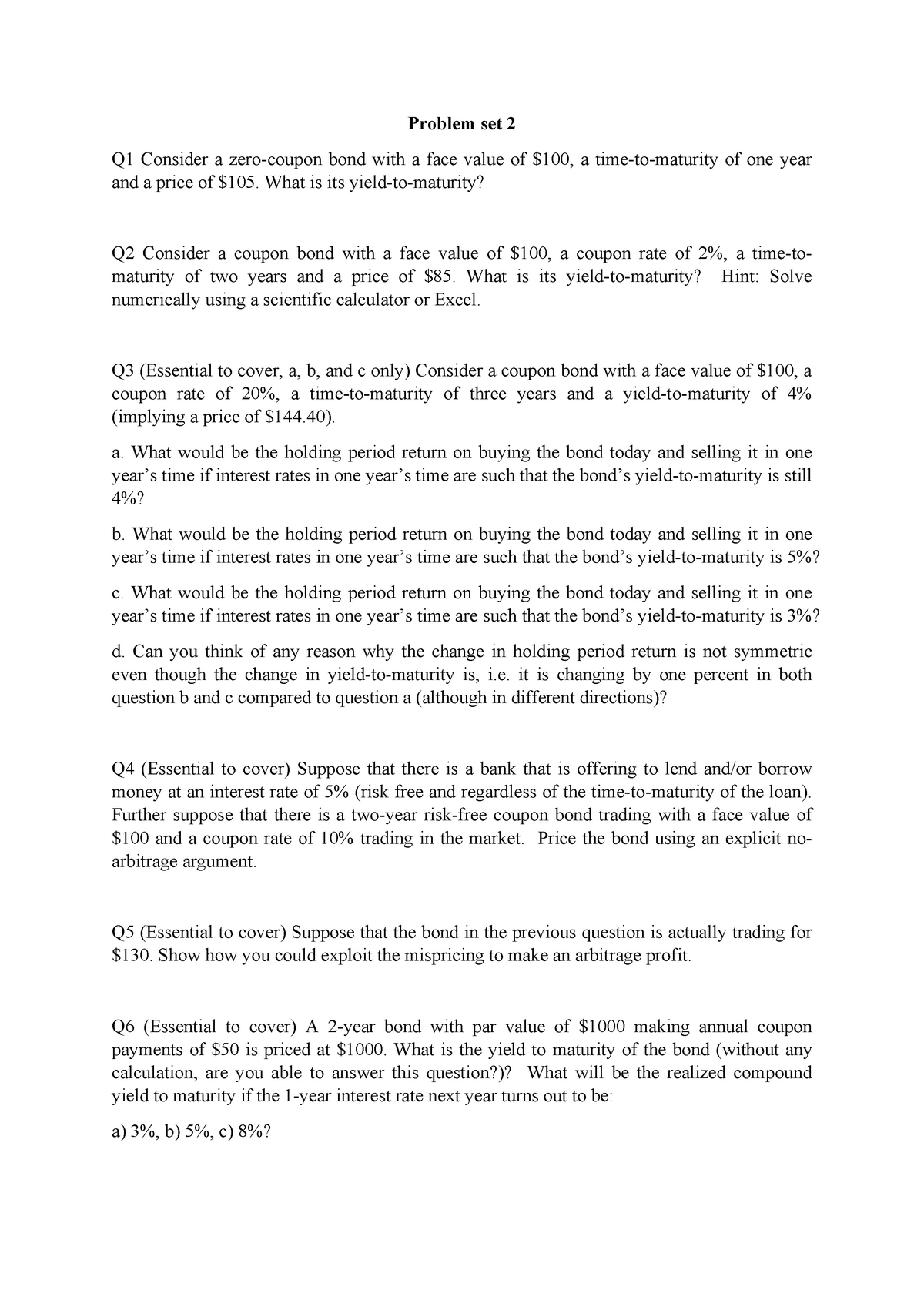

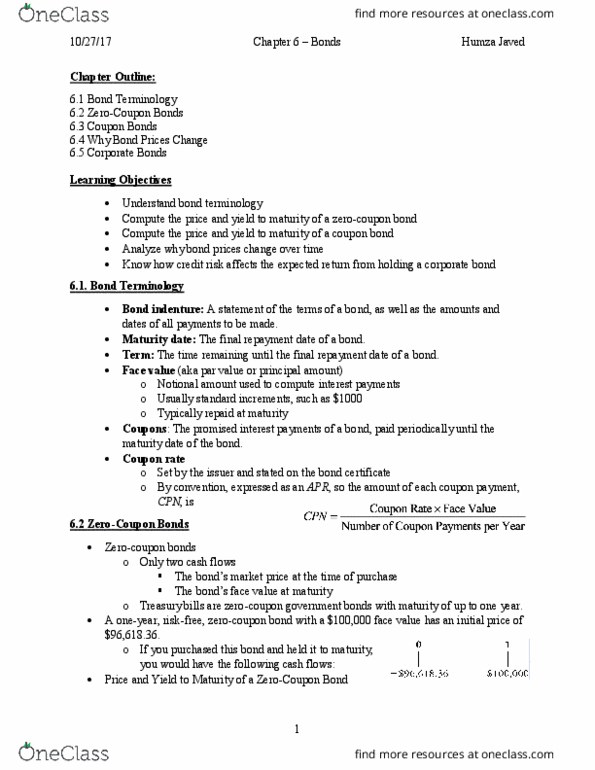

Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. Latest Business News | BSE | IPO News - Moneycontrol Nov 10, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

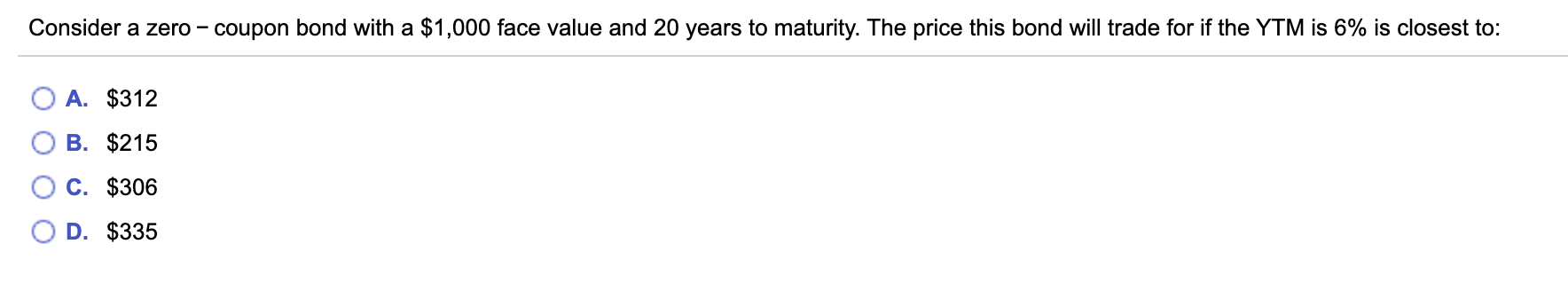

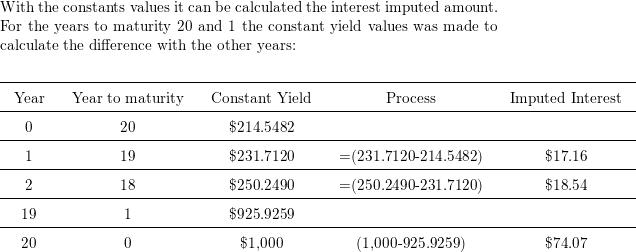

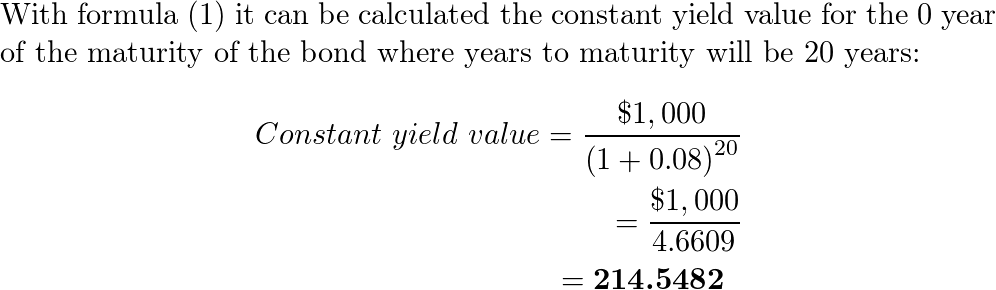

Consider a zero coupon bond with 20 years to maturity

Find Jobs in Germany: Job Search - Expatica Germany Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language. What Is a Certificate of Deposit (CD) and What Can It Do for You? May 18, 2022 · Certificate Of Deposit - CD: A certificate of deposit (CD) is a savings certificate with a fixed maturity date , specified fixed interest rate and can be issued in any denomination aside from ... Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · In a graph posted at Microsoft’s Activision Blizzard acquisition site, the company depicts the entire gaming market as worth $165 billion in 2020, with consoles making up $33 billion (20 percent ...

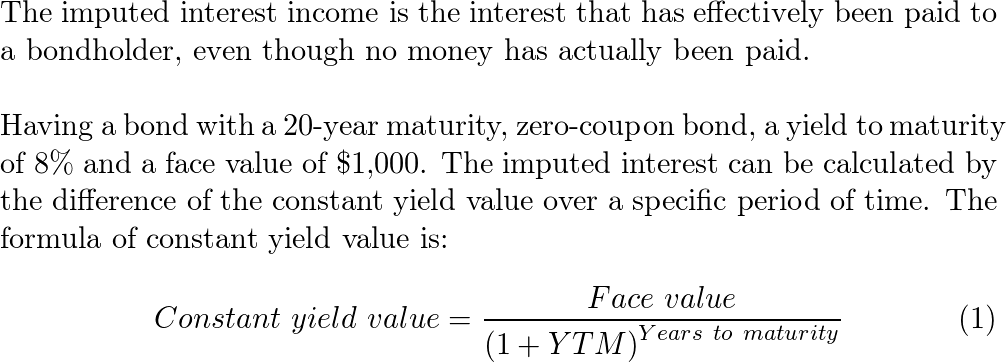

Consider a zero coupon bond with 20 years to maturity. Publication 550 (2021), Investment Income and Expenses ... One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. (If you hold the bond at maturity, you will recognize $20 ($1,000 − $980) of capital gain.) Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · In a graph posted at Microsoft’s Activision Blizzard acquisition site, the company depicts the entire gaming market as worth $165 billion in 2020, with consoles making up $33 billion (20 percent ... What Is a Certificate of Deposit (CD) and What Can It Do for You? May 18, 2022 · Certificate Of Deposit - CD: A certificate of deposit (CD) is a savings certificate with a fixed maturity date , specified fixed interest rate and can be issued in any denomination aside from ... Find Jobs in Germany: Job Search - Expatica Germany Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language.

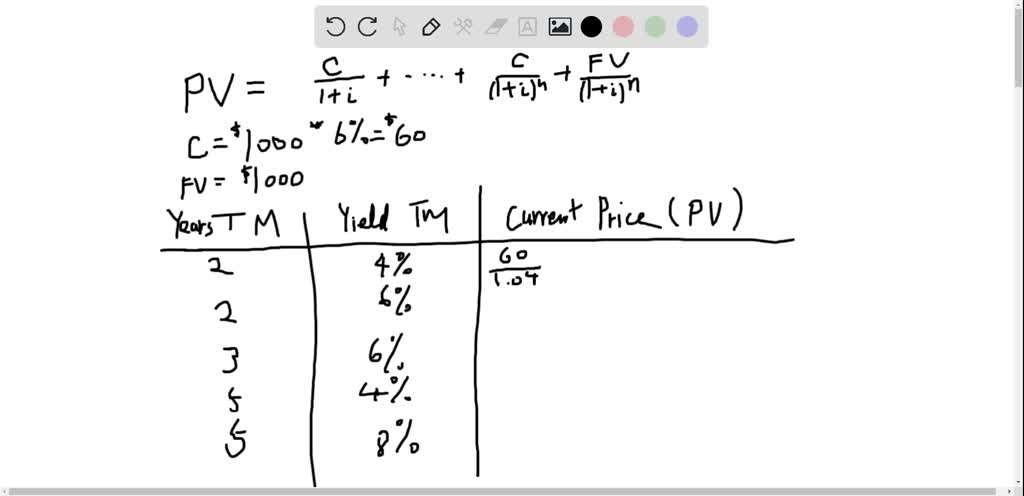

Consider a bond with a 6 % annual coupon and a face value of 1,000 . Complete the following table. What relationships do you observe between years to maturity, yield to maturity, and the current ...

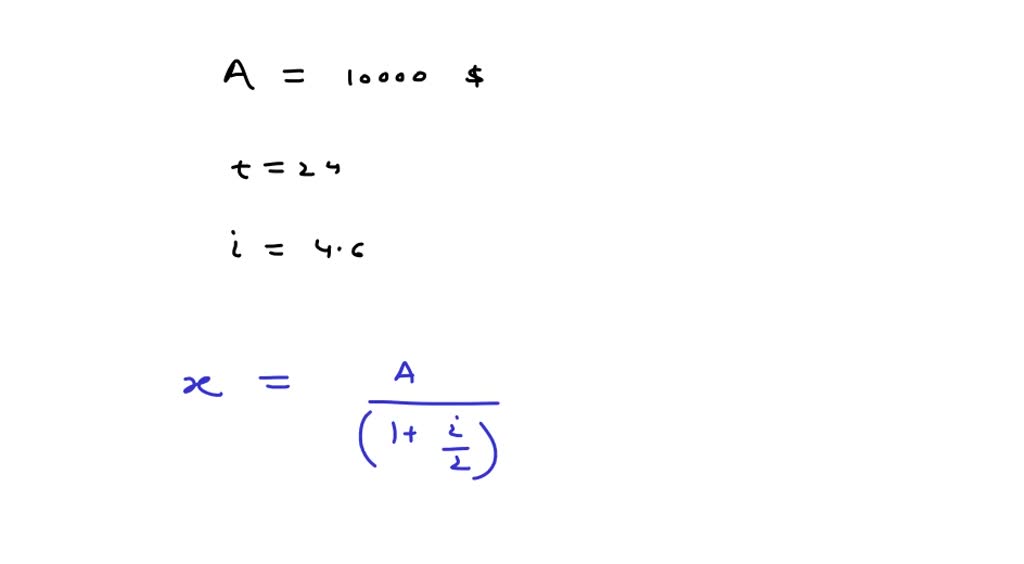

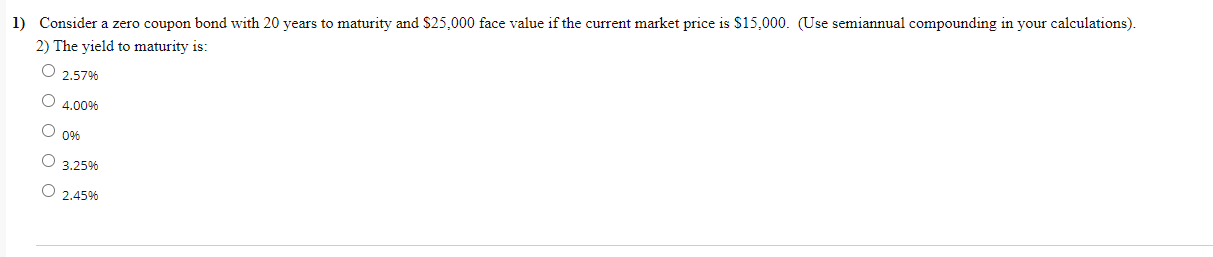

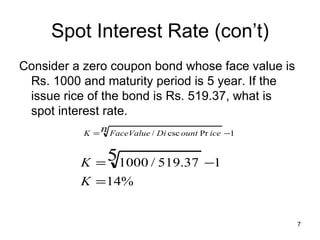

You find a zero coupon bond with a par value of 10,000 and 24 years to maturity. The yield to maturity on this bond is 4.6 percent. Assume semiannual compounding periods. What is the price of the bond

Post a Comment for "40 consider a zero coupon bond with 20 years to maturity"